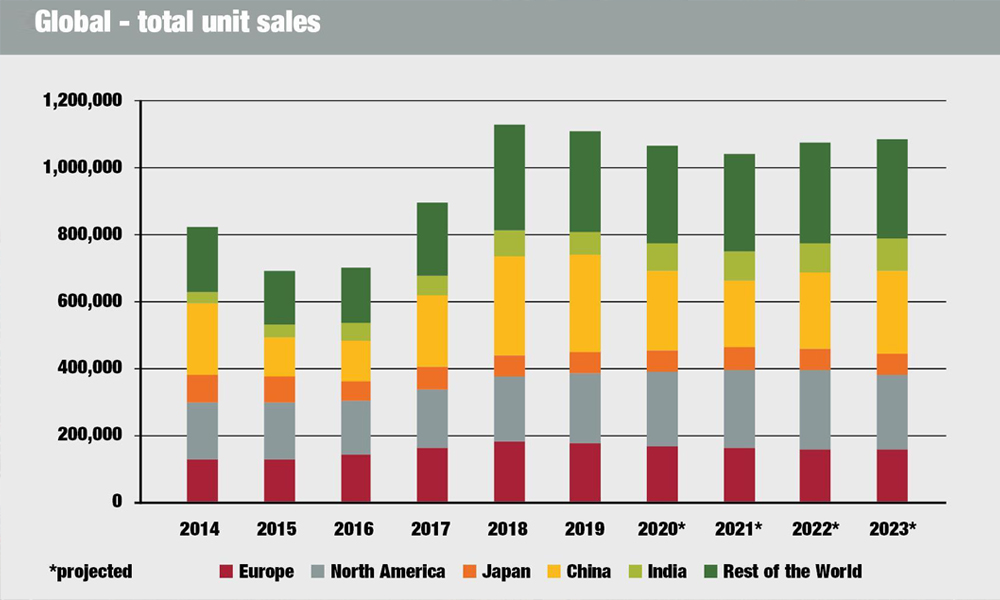

The global construction equipment sector recorded total sales of 1.1 million units at a retail value of $110 billion last year, touching an all-time high.

According to a study by Off-Highway Research, the 2018 figures are higher than the previous record of 2011, during the peak of the Chinese spending, as well as the figures recorded in 2007. This time, North America and Europe also contributed to the global upturn, along with Asia.

Both China and India saw remarkable increase in sales, with the Chinese market registering a 37% growth to reach 343,817 units – the highest demand it has seen since 2012.

This means that China once again emerged as the largest equipment market in the world last year.

India saw sales surge 35%, showing high growth for the third year in a row and taking the market to a record high of 98,204 units. This is an increase of 44% above the previous highs of 2011 and more than double the demand three years ago during the cyclical low point of 2014 and 2015.

Western Europe hit its highest figure for a decade last year with a 10% rise to 177,694 units. Demand rose in 14 out of the 15 largest markets in the region, led by Germany and the UK. The report noted that last time the German market showed such strength was in the early 1990 during the construction boom after the German reunification.

Sales rose in North America too, with an increase of 13% in demand taking the number of units sold to some 195,500.

Among the world’s largest markets, the only low point came from Japan, which saw a 5% fall in sales to 63,700 units, said Off-Highway Research.

The report projected only a moderate decline in global demand this year, despite terming 2018 as a likely peak in the current cycle. According to forecasts in the report, global sales will remain above a million units in 2019, the fourth year in history that the six-figure mark will be achieved.