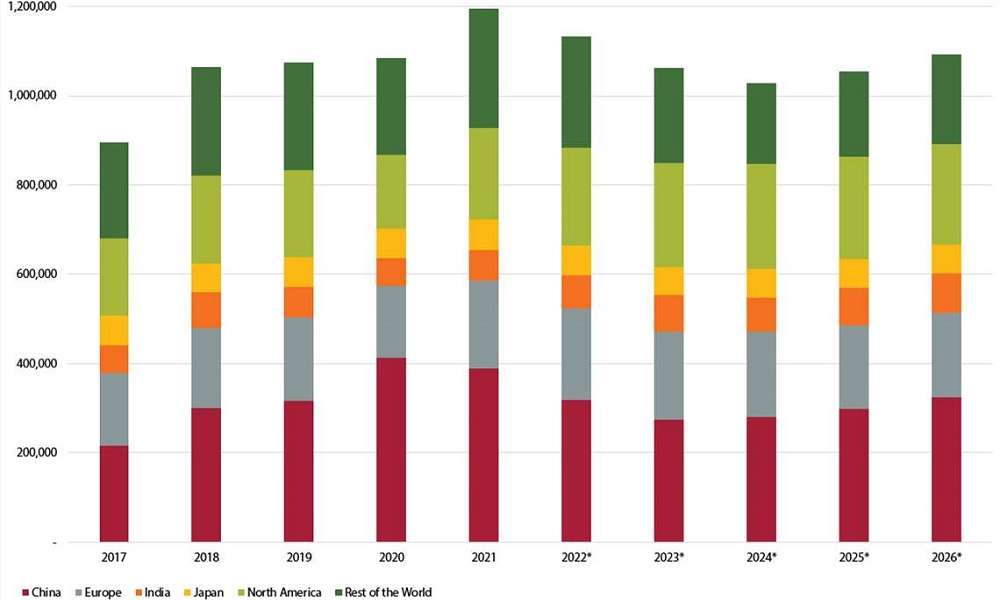

Global construction equipment sales rose 10% in 2021 to a new record of 1.196 million units, according to the latest findings by Off-Highway Research.

The global market research company’s newly updated Global Volume & Value Service report revealed that all major world markets, apart from China, experienced growth last year.

Off-Highway Research managing director, Chris Sleight said: “The combination of low interest rates, stimulus spending on infrastructure and high commodity prices last year was a heady combination for the construction equipment market. Residential construction is booming, there is strong demand for equipment from mines and the pipeline of infrastructure work looks solid.”

According to the report some of the most robust growth was seen in North America (up 25%) and Western Europe (up 22%), while emerging markets, excluding India and China, were up 24%. It said a 5% drop in demand is expected this year, yet 2022 would still show the second highest sales volume on record.

Sleight added, “Equipment sales in China have moved to a different rhythm to the rest of the world since the start of the Covid pandemic. China quickly put stimulus in place at the start of the global pandemic in March 2020. As a result, it saw 30% growth in its equipment sales last year, to take the market to volumes which had not been seen for a decade.

“However, this stimulus push was soon spent, and equipment sales started to fall in the second quarter of 2021. Although the downturn was steep, the extremely high volumes of equipment sold in the first quarter had an offsetting effect, and the market as a whole fell only six per cent overall in 2021.”

The outlook for this year remains upbeat, with further equipment sales growth expected in many countries, again with the exception of China. “As has been widely reported, demand for construction equipment globally is much higher than can be met by the available supply, while shipping bottlenecks are an unwelcome contributor to long lead times. Many manufacturers report that they are sold out for 2022, so we expect global equipment sales to stay at high levels throughout the year,” said Sleight.