Over the past 12 to 24 months, residential construction has been the key driver of blue-collar job demand in the UAE. The surge in off-plan property sales — spurred by investor confidence and strong demand from end-users — has led to a subsequent spike in project approvals and construction contracts.

This, in turn, has significantly increased the need for skilled blue-collar workers across various trades, says Nikhil Nanda, Director, Innovations Group in a interview with Construction Machinery ME.

The UAE’s construction sector is experiencing a transformative surge, fuelled by record off-plan residential sales, government-backed infrastructure goals, and the increasing complexity of mega-project delivery. At the centre of this boom is a rapidly intensifying demand for skilled blue-collar workers—a demand that has outpaced actual hiring and exposed deep-rooted structural challenges in mobilisation, compensation, and workforce development.

According to Innovations Group’s Workforce Trends & Market Insights Summer 2024 report, blue-collar job demand in the UAE has grown by 69% year-on-year. Yet, the market also witnessed a surprising 21% decline in actual hirings — a paradox that, as Nanda explains, is about more than just numbers.

“The talent availability gap is less about quantity and more about quality and compensation,” Nanda tells Construction Machinery Middle East. “While the UAE continues to attract interest through its world-class infrastructure and pro-immigration policies, many skilled workers are gravitating towards regions offering higher wages — such as Malaysia, Saudi Arabia, Romania, and Israel.”

Residential development has emerged as the single biggest driver of construction activity, reshaping the urban landscape and placing immense pressure on the skilled labour pipeline.

“We’ve observed exponential growth — almost three to four times the previous volume — in construction activity in areas like Dubai Hills, Sobha Hartland, and Al Furjan,” Nanda notes. “These are not isolated trends but part of a broader development cycle transforming how and where people live in Dubai.”

As developers fast-track handovers to meet investor demand and end-user expectations, the need for qualified trades — masons, electricians, HVAC technicians, steel fixers — has reached unprecedented levels.

Wage Disparities and Labour Flight

Despite this boom, the report highlights a growing mismatch between the market’s needs and its ability to secure the right talent. A major factor? Pay.

“The discrepancy between the demand and the salaries offered in the UAE, especially for skilled blue-collar roles, is a significant barrier,” says Nanda. “Without meaningful wage alignment or structured benefits, many qualified candidates choose other markets, creating a bottleneck for mobilisation.”

The report also reveals that India—traditionally the largest source of skilled blue-collar workers—has seen a marked decline in outbound placements to the UAE. Nepal, meanwhile, is exporting more labour to the Emirates than at any point in its history, and African markets are becoming key contributors.

“We’ve seen a clear shift in sourcing trends,” says Nanda. “Nepal is currently at its highest ever level of manpower export to the UAE, while Africa, has become a fast-growing source of blue-collar talent.

“Conversely, India’s contribution has declined, largely because Indian workers now have access to better-paying opportunities in Europe, the Middle East, and Asia. This evolving landscape is reshaping how and where UAE employers focus their recruitment efforts.”

Shifting Employer Preferences

Another emerging trend is the move away from formal certifications as the default yardstick for candidate selection. According to Nanda, employers are now more focused on real-world, site-specific skillsets.

“Especially in blue-collar segments, practical tests and hands-on assessments are being prioritised over certificates,” he explains. “This has somewhat reduced recruitment timelines and allowed employers to make faster, more confident hires.”

With rising global awareness of wage fairness and inflation pressures mounting across all economies, worker expectations are changing fast. Employers in the UAE are responding by expanding their sourcing beyond capital cities and investing in grassroots mobilisation.

“Worker expectations are rising in tandem with the global awareness of fair wages and cost-of-living challenges. This is prompting employers in the UAE to adapt their sourcing models, often by extending their reach beyond major cities into tier-2 and tier-3 towns, where wage expectations are relatively modest. This also means that recruitment teams must now invest more in ground-level headhunting, partner deeper with local agents, and often carry out pre-departure engagement to ensure a smooth mobilisation process.”

Addressing the Skills Mismatch

At Innovations Group, bridging the skills gap means taking a long view. Their solution lies in strategic partnerships across Africa, Europe, and Latin America—combined with a robust post-placement upskilling programme.

“We’re proactively addressing the skill gap through a multi-country, multi-stage approach. We’re expanding our sourcing footprint by partnering with local recruitment firms in Africa, Europe, and Latin America, thereby diversifying the talent pipeline.”

In addition, it has launched a career progression initiative that upskills and mentors blue-collar workers post-placement. This builds both employer confidence and worker loyalty.

“Many of our placements in the UAE work with us for 2–5 years, after which we facilitate their movement into higher-wage regions such as KSA, Romania, or the UK. This not only meets employer demands but also builds loyalty and a sense of growth among our workers,” Nanda says.

Acute Shortages in Logistics and Driving Roles

The crunch is perhaps most visible in logistics. As UAE-based cement factories and suppliers race to meet demand, qualified heavy-duty truck drivers have become scarce.

Contractors are now sponsoring driver training and licensing initiatives or fast-tracking partially trained drivers through certification processes. Nanda explains that this is one of the clearest examples where investment in skills brings immediate operational returns.

“Yes, heavy-duty truck drivers are in critically short supply. With a sharp uptick in construction activity, cement plants and material suppliers are dispatching more loads than ever before. Yet the availability of licensed, experienced drivers remains low.

“Contractors are responding by sponsoring driver training and licensing programs, or working closely with manpower partners to source partially trained drivers and fast-track them through local certification requirements. It’s a clear case where investing in training yields direct operational returns.

Construction vs. Logistics: A Tale of Two Sectors

While the construction sector is enjoying explosive growth—with a 56% surge in workforce demand—logistics presents a more nuanced picture.

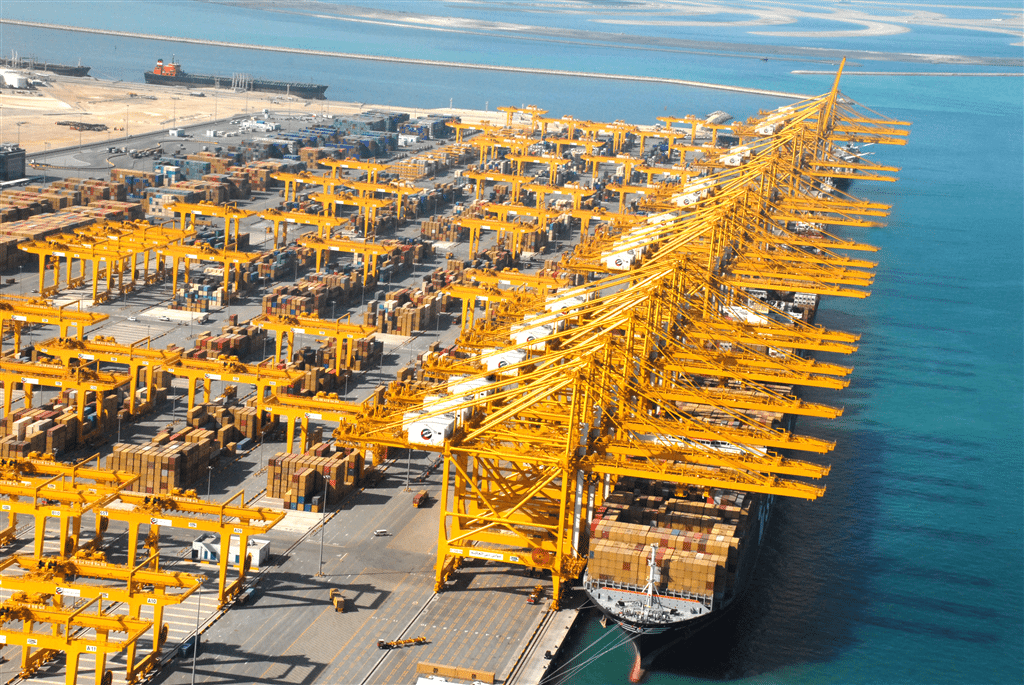

“Global logistics saw a 48% contraction,” says Nanda, referencing the report. “But in the UAE, geopolitical instability and trade route redirection have increased port-side operations. The result is a spike in demand for O&M roles in customs, warehousing, and heavy transport.”

The UAE’s construction and logistics sectors are currently moving in two distinct directions—one in aggressive expansion, the other in strategic recalibration.

“In construction, we’ve seen a 56% increase in workforce demand, primarily driven by a pipeline of mega residential and commercial projects slated for delivery through 2026–2029. Off-plan residential sales have reached historic highs, and this surge has triggered peak-level construction activity. As a result, skilled roles such as steel fixers, masons, carpenters, HVAC technicians, and site supervisors are in extremely high demand.

“In contrast, the logistics sector is grappling with mixed signals. While global shipping and logistics activity saw a 48% contraction — largely due to ongoing disruptions in international trade routes and post-pandemic recalibrations — the UAE’s strategic geographic position has led to a counterbalancing uptick in port-based activity. Due to regional geopolitical instability, cargo redirection through UAE ports has intensified operational and maintenance (O&M) requirements, especially in port logistics, customs handling, warehousing, and heavy vehicle operations.

“From a regional competition standpoint, Saudi Arabia poses a significant challenge. Its Vision 2030 infrastructure megaprojects, backed by aggressive funding and higher wage offerings, are pulling from the same labor pools as the UAE. Skilled blue-collar professionals now have options, and they’re evaluating offers not just on salary, but also on living conditions, benefits, and career progression.”

This bifurcation requires a tailored talent strategy, especially in a region where competition with Saudi Arabia for blue-collar workers is fierce.“Saudi Arabia’s Vision 2030 megaprojects are pulling from the same talent pool,” warns Nanda. “They’re offering higher wages and longer-term contracts. Candidates today evaluate not just salary, but benefits, working conditions, and career paths.”

To remain competitive, Nanda advocates for an evolution in employer mindset. “Transactional hiring is no longer enough. Employers who invest in their workforce will win,” he says:

-

Long-term talent planning

-

On-site and overseas training support

-

Enhanced value propositions for in-demand trades

What’s Next: From Residential to Infrastructure

Looking ahead, Innovations Group predicts a shift in focus starting mid-2025. With residential project saturation looming, government and private-sector investment will pivot toward infrastructure upgrades.

“We expect a wave of civil engineering and utilities hiring—rail, drainage, roadwork, and public transport roles will see a spike,” says Nanda. “This will define the next phase of employment for blue-collar labour in the UAE.”

Cost vs. Competency

One of the biggest balancing acts for employers is maintaining project cost targets while meeting skill and certification needs. Nanda concedes that some corners are being cut—but urges a smarter approach.

“There is a lean towards affordability over pedigree,” he says. “But visionary companies are investing in post-hire training and working with recruitment partners who prioritise skills verification through practical evaluations.”

“This isn’t just about filling jobs—it’s about building the future of construction in the UAE,” concludes Nanda.

Fixing the Labour Supply Chain

The Innovations Group report also includes policy recommendations aimed at closing the talent gap and streamlining workforce planning:

-

Trade-specific minimum wages: To prevent undercutting and ensure fairness

-

Performance-based visa quotas: To reward ethical recruitment and operational excellence

-

Public-private training partnerships: Especially in source markets, aligning skills with UAE site needs