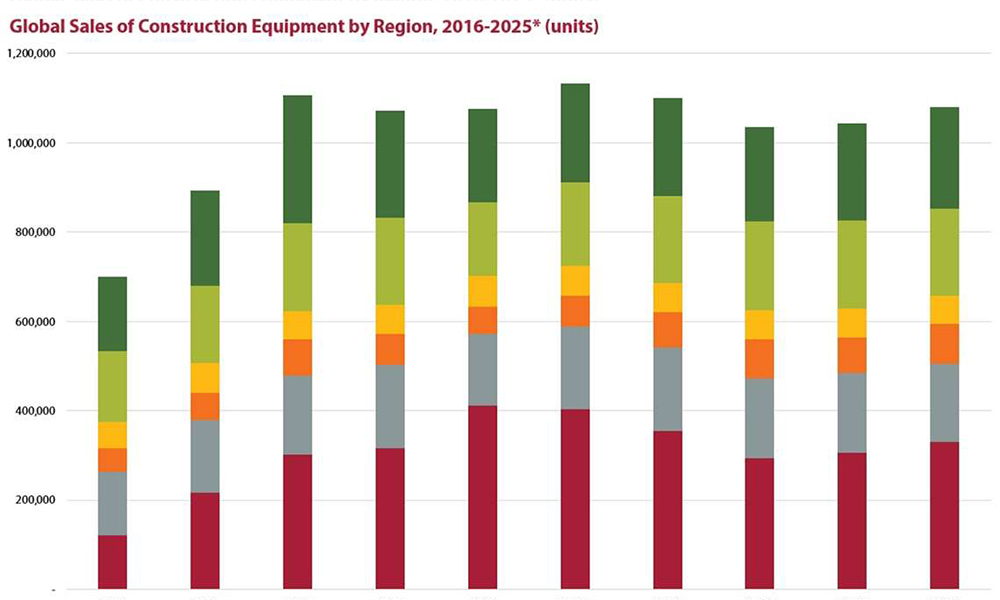

A new report from specialist market research company Off-Highway Research projects sales of construction equipment to hit $110bn globally this year, with expected unit figures of 1.13 million.

The forecast says that this figure, if it were to be realised, would be a record high, beating the 1.11 million units sold in 2018 by 2%.

According to Off-Highway Research, stimulus packages by governments around the globe in response to the Covid-19 pandemic will be the reason for the record high, with the Chinese government leading the pack.

This latest prediction was absent before the pandemic hit but responses from government bodies has led to the revision. As an example of these responses, Off-Highway Research cited special bonds issues by Chinese provinces last year to raise money for infrastructure work. These and other stimulus packages have already led o the Chinese equipment market rising 30% in a growth that continued into Q1 2021. Even with the Chinese market slowing down since, the total sales for 2021 are expected to be only 2% lower.

Meanwhile, other global markets are expected to continue rising this year, with Off-Highway Research projecting the European market to grow by 15% in in 2021, an upward revision of its previous forecast which had a single-digit figure. In terms of volume, Europe is can be expected to reach levels similar to its cyclical high in 2019, the report added.

The report also projects an increase of 13% for North America, which will keep it just shy of the high point of that market in 2019. Japan, too, will register a rise of 1%, which, though modest, will beat expectations of negative growth.

The big downgrade in this year’s forecast comes for India, whose figures have been revised downwards to 11% from the previous level of 15%, owing to the second wave of Covid infections in the country in Q2 this year.

For the rest of the world, including markets such as Africa, South America and the Middle East, Off-Highway Research forecasts an average sales growth rate of 6% this year.

Chris Sleight, managing director, Off-Highway Research, said: “The global rebound in equipment sales over the last six to nine months has been striking. While this is excellent news, the industry still faces many challenges in meeting this demand, including supply chain constraints and bottlenecks around shipping and other logistics. I believe that, without these, sales this year might have been even higher than the record volumes we are predicting. However, the positive in this is that the current buoyancy should extend well into 2022 as a result.”